By: Nghiinomenwa-vali Hangala

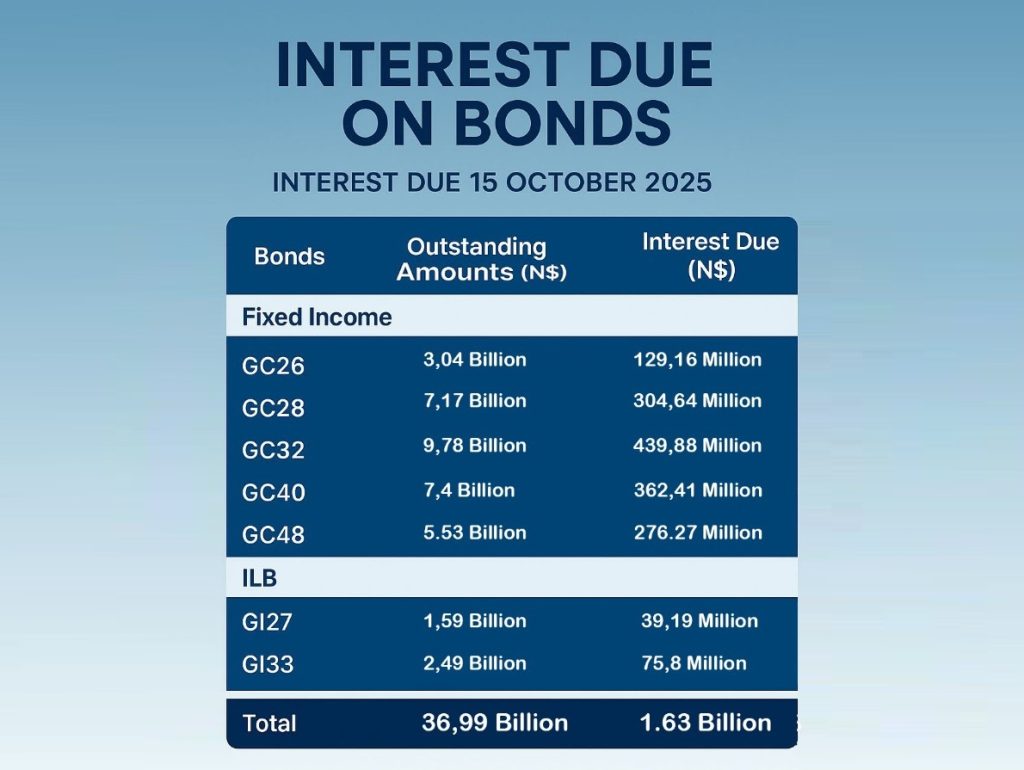

Updates from the Central Bank have indicated that the government will be paying N$1.6 billion in coupon interest to its bond investors on 15 October 2025.

Information from the Bank of Namibia revealed that, as part of its seven outstanding (fixed income and inflation-linked) government bonds, it will be paying interest/coupons in 2025.

The government owes N$36.9 billion through its seven bonds, where it pays coupon interest twice a year. As a result, on 15 October 2025, it will pay N$1.6 billion to the various investors it borrowed from as part of the arrangements.

The biggest earners are the GC32 bond investors – they have lent N$9.8 billion to the government thus far. Consequently, the government will pay the GC32 investors N$439.9 million in interest payments as dividends for using their money.

The second-highest earners will be the investors in the GC40 who have lent N$7.4 billion to the government. For this, they will receive N$362.4 million in interest payments, followed by the GC28 investors who will receive N$304.7 million.

As for the investors in the two inflation-linked bonds, the GI27 and GI32, who lent N$4 billion to the government, they will receive N$114.8 million in interest payments on 15 October 2025.

In turning to the market for capital, government budget deficit provided an avenue for investment through an auction of its fixed income assets (bonds and treasury bills).